Death Spirals and Other Things That Go Bump in the Night

A 2014 Year in Review

The following article was written specially for the Association of Energy Services Professionals, and appeared in the January and February issues of AESP’s member magazine, Strategies.

2014 saw many new initiatives in the energy world, spurred by visions of utility death spirals, solar panels, microgrids and duck curves. Seldom over the last 30 years has the energy market bustled with such a plethora of activities. Indeed the very structure of the utility business that has remained largely unchanged for decades is evolving before our eyes. Not since the deregulation era of the late 1990s have we seen such a potential for change.

Legislation/Regulation

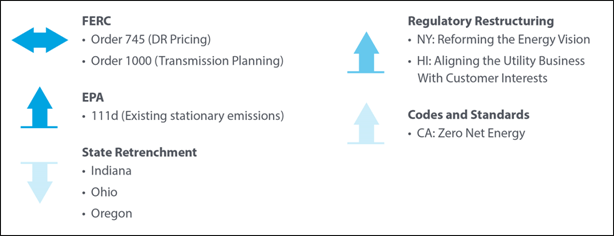

Numerous initiatives impacting the energy industry surfaced in 2014, occurring at both the state and federal level, in legislatures and in regulatory commissions. Figure 1 illustrates examples of the anticipated impacts of several key initiatives on energy efficiency.

FERC Order 745

FERC order 745 was issued in 2011. The order required grid operators to pay a locational marginal price for demand response resources in real-time and day-ahead markets. The order recognized that demand response programs could reduce price volatility. In May 2014, the U.S. Court of Appeals in Washington, D.C., vacated the order stating that establishing prices for a retail product such as demand response programs is under state, not federal, jurisdiction.

The impact of the court’s action may be miniscule. According to Greentech Media, FERC order 745 is not the only issue shifting in the capacity markets. In a May 27, 2014 article, it notes that demand management and energy efficiency are becoming much more integrated into the daily operations of the grid and are expected to continue to grow in coming years. Indeed, what is changing is that demand response is becoming a year-round capacity resource.

The issue is far from decided. In October 2014, the Appeals Court granted a stay of its decision pending an appeal by FERC to the U.S. Supreme Court. Demand response aggregators such as EnerNoc are actively intervening in support of FERC’s order. Also gathering are opponents such as FirstEnergy, which has a pending complaint to remove demand response entirely from the capacity market.

Which leads us to transmission planning…

FERC Order 1000

Established energy markets such as PJM and CAISO plan for transmission needs on a regional basis; however, large portions of the country are not covered by independent system operators (ISOs), mainly in the West (outside of California) and Southeast. FERC Order 1000 would require that utilities in those areas plan for transmission on a regional basis, including consideration of non-wire solutions such as distributed generation, energy efficiency, and demand response.

In August 2014, the D.C. Circuit Court of Appeals rejected challenges to the order. Utilities in non-ISO areas will begin planning for transmission needs on a regional basis and will take into consideration the impacts of federal, state, and local public policies such as renewable energy and energy efficiency portfolio requirements on grid investments.

The states have been active as well…

State Activity

Legislators and commissioners at the state level continue to shape energy policy. While overall investment in energy efficiency continues to increase, individual states have both accelerated their efforts and pulled back the reins.

In 2014, California’s new Title 24 codes went into effect. Evolving Title 24 codes are intended to push the market to zero-net-energy for residential buildings by 2020 and for commercial buildings by 2030. Three years in the making, the new standards were the result of more than 45 industry stakeholder groups and 15 public workshops. Title 24 takes a comprehensive building approach, first focusing on energy efficiency then incorporating distributed generation. Among its interests is plug loads, which now represent about a third of electricity use, and lighting. The standards require that all 120-volt receptacles be controlled and also require automated day-lighting and lighting demand response systems. The standards include roofs that are “solar ready.”

Slowing energy efficiency investments was the order of the day in Indiana and Ohio. In Indiana, Senate Bill 340 discontinued the statewide Energizing Indiana program at the end of 2014. At the governor’s direction, the Indiana Utility Regulatory Commission developed new energy efficiency recommendations that include: 1) establishing energy efficiency targets through each utility’s integrated resource planning process; 2) comparing Indiana programs to those of neighboring states; 3) requiring third-party evaluation, measurement, and verification; and 4) allowing large commercial/industrial customers to opt out of the program.

Ohio is also pulling back on the reins. Senate Bill 310 froze the state’s renewable energy and energy efficiency targets for two years. A legislative committee will review the standards and propose changes next September. FirstEnergy announced it would eliminate most of its energy efficiency programs at the end of 2014, saving customers “tens of millions of dollars” according to company spokesperson Diane Francis.

The 2014 ACEEE State Scorecard notes the impacts of these decisions. Indiana’s ranking dropped the most of any state, by 13 spots, due in part to legislators’ decision to eliminate the state’s long-term energy savings goals. Legislators in Ohio made a similar decision to freeze and substantially weaken the state’s energy efficiency resource standard (EERS), contributing to the state’s fall of seven spots in the rankings. Despite these policy setbacks, utilities in both states have indicated they will continue running efficiency programs, albeit at levels below what would have been required by the standards.

In Oregon, cost-effectiveness has become an issue. The Oregon Public Utilities Commission decided to eliminate the incentives offered for wall, floor, and duct insulation in single-family and multifamily homes heated with natural gas; solar water heating; windows in multifamily homes; and commercial vent hoods. These measures failed to pass a cost-effectiveness screen due to the expansion of hydraulic fracturing and subsequently low forecasts for natural gas prices.

Florida pulled the plug on solar generation and raised its own concern about energy efficiency program cost-effectiveness late in the year. Solar rebate programs in the Sunshine State will be terminated by the end of 2015. A series of workshops will consider replacements. The commission also accepted several of the state’s utilities’ and other parties’ recommendation that the Rate Impact Measure (RIM) test be the cost-effectiveness threshold for energy efficiency program goals. Florida Power & Light’s energy efficiency targets were reduced by 90 percent due to potential rate impacts.

Meanwhile at the federal level…

EPA Clean Power Plan or Section 111(d) of the Clean Air Act

This 800-pound gorilla was released by the U.S. Environmental Protection Agency (EPA) in June and has climbed to the top of the tower while stakeholders, at last count more than 20,000, scurried around the base of the tower throwing over 1.2 million comments in an effort to either dislodge the gorilla or feed and nourish it.

The Clean Power Plan establishes state-specific targets for carbon emissions that ultimately aim to reduce carbon emissions 30 percent by 2030. The EPA established the targets by assuming: 1) efficiency improvements could be made at coal plants; 2) natural gas-fueled generation could be increased; 3) nuclear production could be maintained or increased, and renewable generation would increase; and 4) states could meet energy efficiency targets. While the EPA used these “building blocks” to establish the state-specific targets, each state has the flexibility to achieve its targets through any combination of the four building blocks or other means as it deems appropriate.

The rule will have a transformative impact on the industry. Coal-based electric production will decrease significantly while natural gas and renewable generation will increase. Energy efficiency will play a key role in reducing overall generation, though research by the Electric Power Research Institute (EPRI) suggests that the 1.5 percent annual reduction in sales assumed in the EPA targets exceeds the technical, economic, and achievable energy efficiency potential.

On the bright (and efficient side)…

New Technologies and Market Players

A number of new technologies and market players emerged in 2014 that will help customers reduce and better manage their electricity use. Some are ready for market, some are still being developed. LEDs and smart thermostats became mainstream in 2014. New energy market players such as Google dove in to participate. Battery technology continued to advance and prices continued to fall, raising the potential for more customers to divorce themselves from the grid with a combination of solar generation and battery storage. And just glimmering over the distant horizon, small-scale nuclear fusion threatens to change the game altogether with limitless, emission-free power that’s too cheap to meter (wait, have I heard that before?).

The Year of the LED

The LED is following in the footsteps of its predecessor, the CFL, but it is generating far more excitement. Although many consumers adopted CFLs to save energy and reluctantly accepted perceived shortcomings such as slow startup, lack of dimmability, and harsh color, LEDs are offering to be the jazzy snazzy light of the future. Sure, they save even more energy than CFLs and last longer too, but that’s not why my daughter wants them. She wants a multicolored, iPhone-controllable LED light pack. Admit it, at the beginning of 2014, you were not expecting to have iPhone-controllable lights on your wish list.

And did I mention thermostats…?

NEST

Programmable thermostats have been around for ages. The energy efficiency industry has argued back and forth whether they save any energy. Frequently, they are not programmed correctly or the program is overridden rendering impotent whatever value they had. In 2014 a new form of thermostat came along, and I do mean a new form. The NEST thermostat looks and functions like no other. It doesn’t need programming, it senses when you are home and learns from your behavior. Oh, and you can control it from your iPhone as well. Other manufacturers quickly followed suit.

But what if we didn’t need to save any energy…?

Fusion

No, not the cross between kimchi and tacos, I’m talking about the nuclear kind. Lockheed Martin’s Skunk Works announced in October a compact fusion reactor. The reactor is small enough to fit on a flatbed truck and, unlike fission reactors, produces little waste. To understand the breakthrough, one first has to recognize that current fusion reactors rely on tokamaks to maintain plasma in the shape of a torus. As everyone knows, the energy required to run the tokamak is equal to or more than the energy output.

Okay, I’m kidding. We don’t need to know about tokamaks or plasma or toruses to get excited about a new technology that can potentially generate 10 times more power at one-tenth the size of existing nuclear generators. Lockheed predicts that a working prototype will be developed within five years, and a commercial model that generates 100 MW of electricity and the size of a cargo container will be unveiled within 10 years. The small amount of radioactive waste from the reactor, mainly some steel elements in the shell, will have a half-life of 100 years, not the thousands of years of nuclear fission waste, promising cheap, clean abundant energy.

Until then, though, everyone can install a solar panel on their roof. But watch out for the ducks…

Distributed Generation

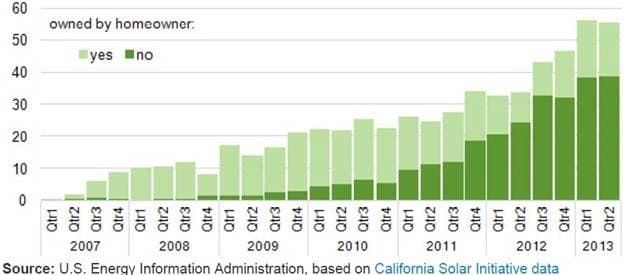

Solar power started generating a lot of attention in 2014. Figure 2 illustrates the capacity of residential solar PV installed in the California Solar Initiative program. Hawaii also observed a substantial increase in residential solar installations, which created a bottleneck within the Hawaiian Electric Company utilities for applications to connect to the grid.

Nameplate capacity (MWDC)

While the total installed capacity is still a small fraction of U.S. generation, the growth is expanding rapidly as costs decline. Deutsche Bank released a report in October that predicts solar generation will be as cheap as or cheaper than average electricity rates in 47 states by 2016 if the federal tax credit remains at its current level. That estimate drops to 36 states if the tax credit declines to only 10 percent.

This has many crying “fowl”…

The Duck Curve

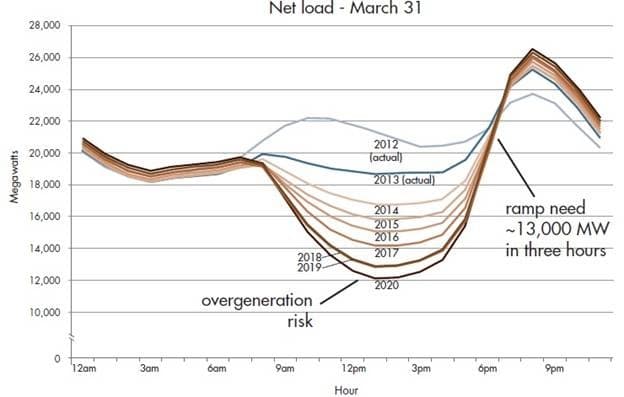

Solar is a resource that flies along its own path. When the sun shines it generates, when it is dark it doesn’t. In general that’s a good thing. Solar is being installed primarily in summer peaking areas of the country and the afternoon sun corresponds nicely with afternoon air conditioning use. However, as the sun declines the drop in solar generation creates the need for a quick ramp-up of other generation, mainly thermal. This creates the aptly termed duck curve displayed in Figure 3 from a California ISO fact sheet.

The resemblance to a watery fowl is uncanny and while interesting to ponder it has system operators scrambling. The belly of the duck presents a situation when the sum of forecast solar output and must-run generation exceeds the demand for energy. Then, as the solar generation declines and the late afternoon peak usage increases, generation must be ramped up quickly to keep the system in balance. In a January 2014 Regulatory Assistance Project paper “Teaching the Duck to Fly,” Jim Lazar proposes a combination of orienting the panels to maximize generation on peak, increasing energy efficiency and demand response, thermal storage, electrical storage (including electric vehicles), and regional transmission diversity—together intended to soak up the excess generation and suppress the peak and making the duck much more manageable.

Of course, all of this distributed generation, energy efficiency, and demand reduction brings us to the brink of demise…the Death Spiral.

Death Spiral

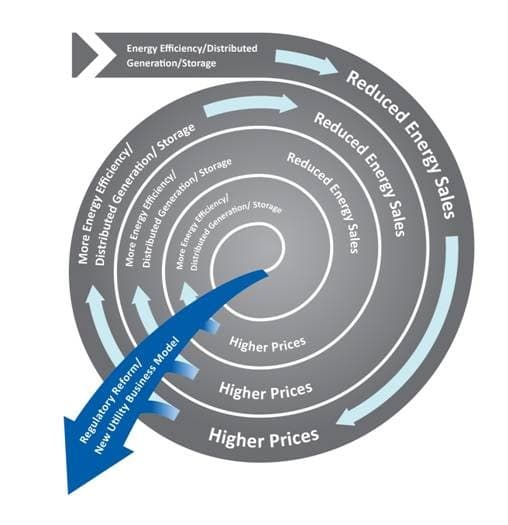

Not to be confused with the figure skating maneuver of the same name, the utility death spiral refers to the reinforcing feedback loop of higher prices for electricity paired with customers who are switching to lower-cost alternatives. As customers adopt more efficient habits and technologies, and in turn generate and store their own electricity, fewer kilowatt hours are purchased from their local utility. This forces the utility to increase electricity prices to cover the fixed costs of maintaining the grid and the generation needed to serve customers at times of peak, which makes additional energy efficiency and generation options more cost-effective and leads ever more customers to adopt them and so on and so forth. Ultimately, the utility is left with only a few customers who face exorbitant rates. Figure 4, adapted from a 1995 NASA project management diagram, illustrates the death spiral in action.

Will the death spiral materialize? Market and technological forces are at work pushing the industry in that direction. Regulators and utilities alike are taking a second look at the current utility business model and regulatory compact. They are proposing alternative pricing structures to assure that customers pay a fair price for the services provided by the grid. Some states are revisiting the entire regulated model, anticipating a day when distributed generation, micro-grids, and highly efficient homes and businesses are served primarily by competitive market actors and the role of the regulated utility has evolved to what has been termed Utility 2.0.

New York and Hawaii are leading the way…

You Say You Want A Revolution?

Rapidly falling costs of distributed generation coupled with upward pressure on prices due to system infrastructure upgrades, flat to declining loads, and a desire for a more resilient grid have prompted state regulatory commissions to begin rethinking the current regulatory compact. For the past century, regulated utilities have been charged with providing safe and reliable power to anyone within their service territory. In return, they were largely protected from competition and provided an opportunity to earn a fair return on their investments. Two states, New York and Hawaii, are revisiting this compact.

New York

Recognizing after Superstorm Sandy the vulnerability of the grid to disruption, the substantial cost of prolonged outage, and the potential benefits of a more active market, the New York Public Service Commission opened a proceeding named Reforming the Energy Vision (REV).

As reported in RenewableEnergyWorld.com, Audrey Zibelman, chair of the New York Public Service Commission, said the initiative is a logical continuation of the reforms that started with the restructuring in the 1990s. She said, “The 21st century grid is going to have a lot more distributed resources. The scope is comprehensive: solar, energy efficiency, storage. Let’s make it the core to the redesign, not ancillary.”

The REV has the following policy objectives:

- Enhanced customer knowledge and tools that will support effective management of their total energy bill

- Market animation and leverage of ratepayer contributions

- System-wide efficiency

- Fuel and resource diversity

- System reliability and resiliency

- Reduction of carbon emissions

The commission has solicited comments from utilities and stakeholders and has scheduled technical conferences to begin working out the details of the reform.

Hawaii

Hawaii’s reform is driven by a grassroots upwelling of solar installations. Hawaii has the highest electric prices in the nation, largely due to needing to import oil for a substantial portion of the generation. As a consequence, solar is a cost-effective alternative. The large volume of solar installations has begun to raise concern about grid management. In its order in Docket 2011-092, the Hawaii Public Service Commission stated that “The commission believes it is timely, necessary and essential to outline fundamental, emerging issues pertaining to the operation and regulation of investor-owned electric utilities in Hawaii to set a course that is mutually beneficial to utility shareholders and utility ratepayers.”

The commission expressed frustration about the lack of a movement to a “sustainable business model” that is “high-performing, customer focused and with affordable rates.” The Hawaii reform emphasizes these three areas:

- Creating a 21st Century Generation System—integration of clean energy resources that cost less than the current oil-fired generation.

- Creating Modern Transmission and Distribution Grids—transforming the grids into modern, advanced networks capable of integrating customer-sited distributed generation.

- Policy and Regulatory Reforms—changes to the regulatory compact to achieve the sustainable business model.

Anticipating 2015

Utilities and service providers will be working to understand, influence, and incorporate the industry changes into their business plans. The market is evolving and while utilities remain the cornerstone of the industry the potential changes resulting from initiatives to reform the regulatory compact, as well as compliance with the Clean Power Plan, are introducing a host of new players. We see the following action items:

- Determine the achievable potential for distributed generation, energy efficiency, and demand response in each state and service territory

- Evaluate emerging technologies

- Establish the cost-effectiveness framework

- Estimate the economic impacts

- Provide customers with information and tools to make informed decisions

- Customer information and marketing strategies

- AMI-based usage information

- Analyze the impacts of alternate compliance scenarios for the Clean Power Plan

- Refine cost of service studies to determine the impacts of distributed generation

- Tailor rate design to meet strategic objectives

- Behavior impacts

- Demand reduction

- Appropriate cost recovery

- Design and implement customer service-based programs for energy efficiency, distributed generation, and demand response

- Optimize the incorporation of these programs through integrated resource planning

- Innovative delivery strategies

- Conduct market research to better understand energy consumer needs and behavior

As we approach the new year, 2015 is shaping up to be every bit as exciting as 2014.